The Real Signal #61 - Mortgage Demand Lowest Level Since 1994

Housekeeping Note:

We are switching our main weekly newsletter from Saturdays to Wednesdays, so the one you are receiving here is the full version. Saturdays’ newsletter will now be the single-article compact version.

This is also our first paid newsletter. To help this transition, through November 30, we are offering a 10% discount on subscription rates to existing subscribers, use the link here.

We appreciate you ;-)

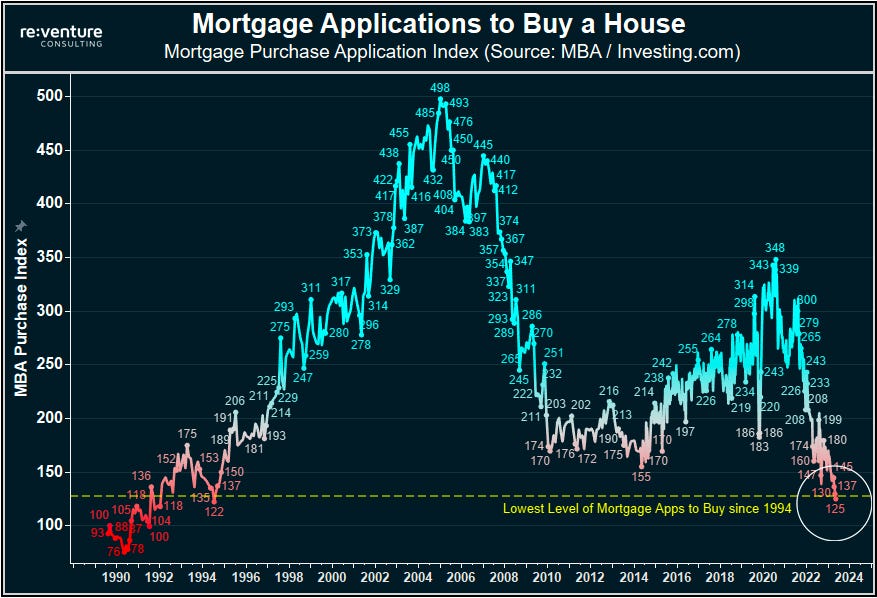

Mortgage Demand Lowest Level Since 1994

“JUST IN: Mortgage demand is now down 50% from pre-pandemic levels and at its lowest level since 1994.

From its peak in 2021, mortgage demand is down ~64%.

Current mortgage demand is ~75% below the 2005 peak.

The most incredible part of this?

Mortgage rates are still only at their historical average.

Housing market activity is coming to a halt.”

Scott Choppin Note:

In Southern California home builders are buying up every parcel of land that’s not nailed down. They are the only new supply in the marketplace, as 90% of borrowers in existing homes are at rates at or below 5% and therefore not selling. Without a return of supply in both new and existing homes, affordability will only get worse. This is story of California…supply constraints in all markets, all products - rental and for-sale housing.

Keep reading with a 7-day free trial

Subscribe to The Real Signal - Housing + Real Estate + Macro to keep reading this post and get 7 days of free access to the full post archives.