The Real Signal #139 - US Debt Crisis And The Fourth Turning

Plus: A Reminder Of The Effects Of Inflation, Recovery Signal In Ground Up Multi, and A New UTH BTR Follow On Investment Opportunity

US Debt Crisis And The Fourth Turning

Scott Choppin Note:

I highly recommend two books to read that were very impactful in my thinking in the last few years. The book the Sovereign Individual describes the rise of information technology, both modern and historic, the changed the course of history and will ultimately dissolve nation-states as we know them. The dissolution will enable individuals to achieve personal autonomy and economic freedoms in the new decentralized (including AI) digital age. The second book I would recommend is called The Fourth Turning, and it argues that history moves in cycles - each about a human lifetime in length - composed of four distinct phases shaped by generational archetypes culminating in a transformative crisis that reshapes society.

These two books work well together when you consider that our fourth turning is most likely a debt crisis in the United States in the 21st century.

“Notably, the long-term debt cycle coincides with the 4th turnings.

I mainly focus on what's happening quantitatively (debt). But keeping in mind the changing social/geopolitical dynamic is a nice accompaniment to that. Old institutions/norms facing entropy, death, rebirth.”

A Reminder Of The Effects Of Inflation

Scott Choppin Note: Pairs nicely with The Fourth Turning above.

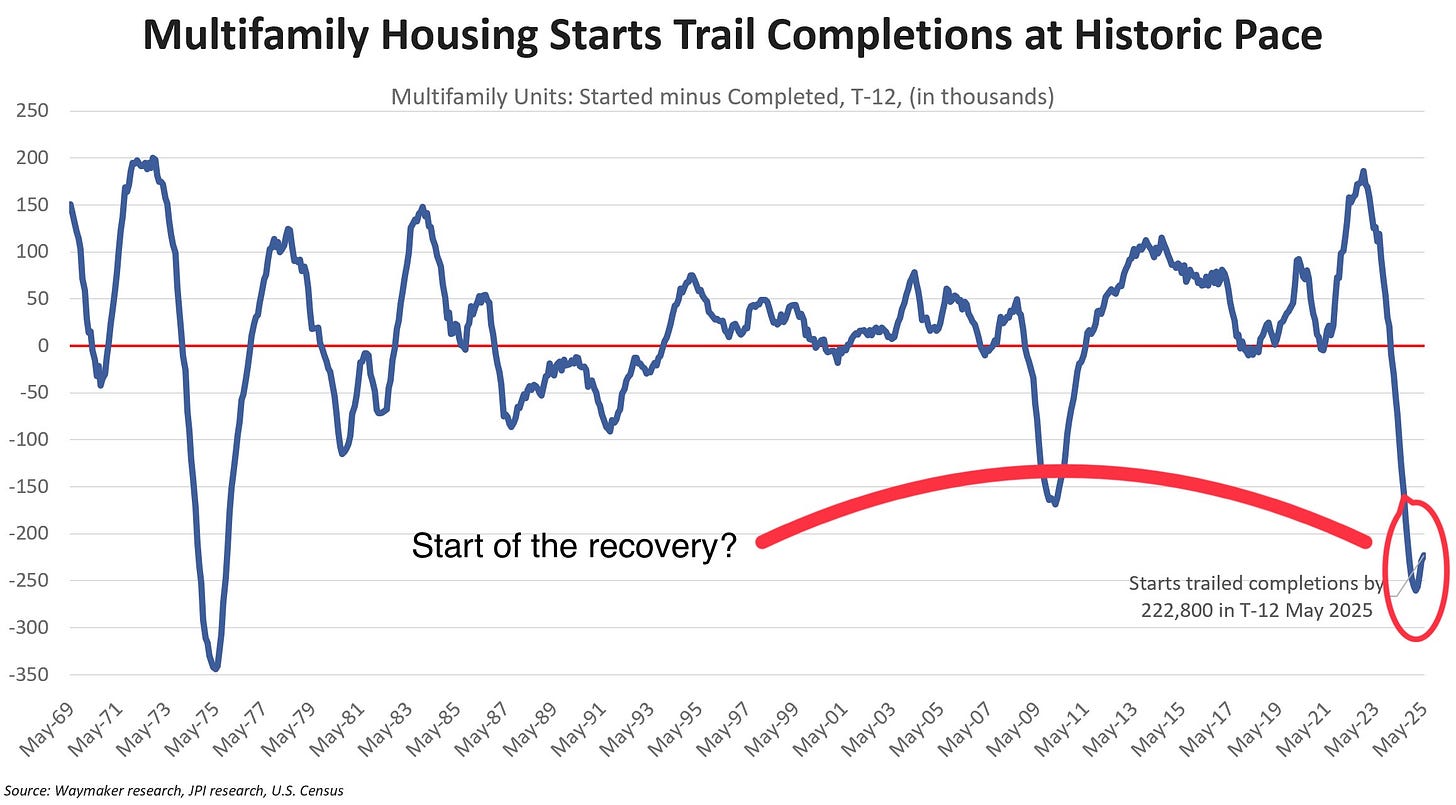

Recovery Signal In Ground Up Multi

“Multifamily construction starts trailed completions by 223k units over the last 12 months.

Ongoing construction totals lowest since 2021, and will almost certainly fall further.

Note the big drop long pre-dated tariffs. High rates are much bigger challenge for developers.”

Follow On UTH BTR Investment Opportunity

Good news! We’re building more UTH workforce housing for families in California. We have in-place LP equity terms sheets on two UTH porfolios tallying 337 units, slated for delivery in the 2026/2027 time period. A few weeks ago, we presented a $20M Opportunity Zone limited partnership investment opportunity. We are pleased to announce that this investment opportunity has now been fully subscribed. The investment opportunities below, are a follow on to the portfolio investments listed above.

Investment Opportunities:

First, a 4-project portfolio with a major institutional investor, where we are offering a $300K GP co-investment opportunity.

Second, a 2-project Opportunity Zone portfolio, offering a $400K OZ GP co-investment opportunity, on a 2-project UTH OZ portfolio.

Both investments are targeting high 6% to low 7%+ YOC.

Please email choppin@urbanpacific.com for more info.

Please note: This investment opportunity is being offered under Rule 506(c) of Regulation D. Participation is limited to accredited investors only. We will take reasonable steps to verify accredited investor status for all participants. Minimum investment is $100,000. Yields are targeted in the high 6% to low 7% range, but are not guaranteed; all investments involve risk.