The Real Signal #138 - For-Sale Home Crash In California

Plus: National Rent Growth Stalls, BTR Future Trend, New UTH BTR Follow On Investment Opportunity

For-Sale Home Crash In California

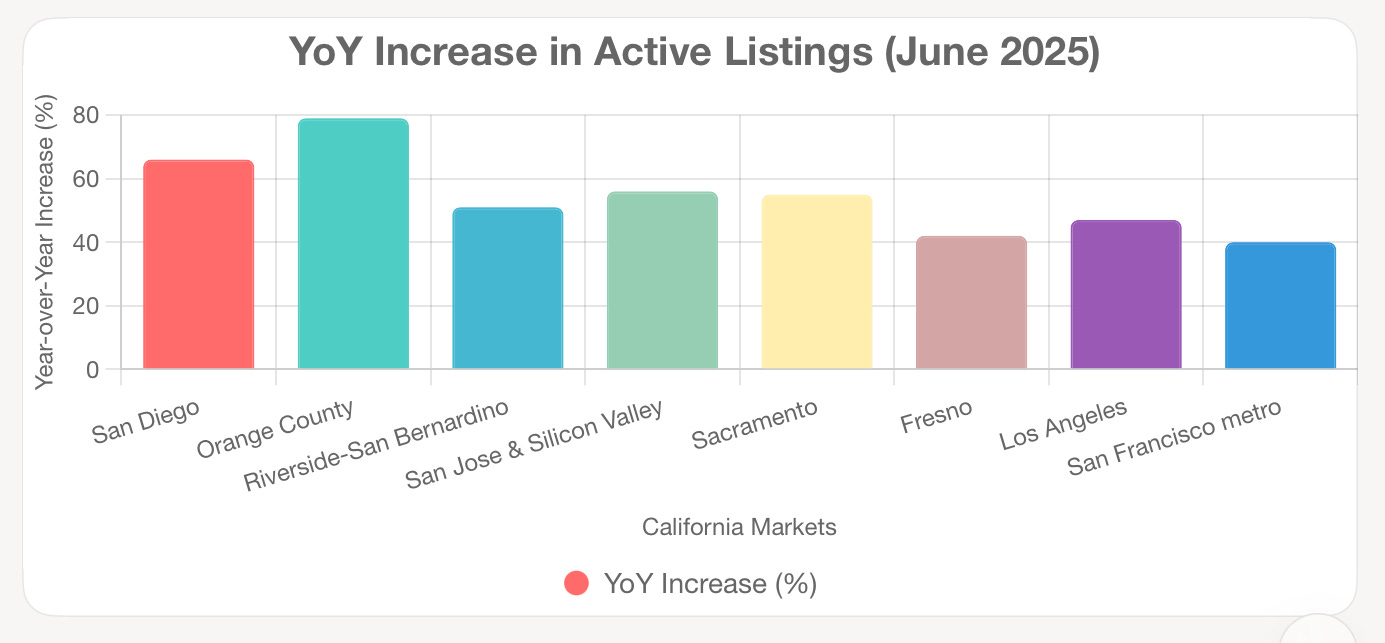

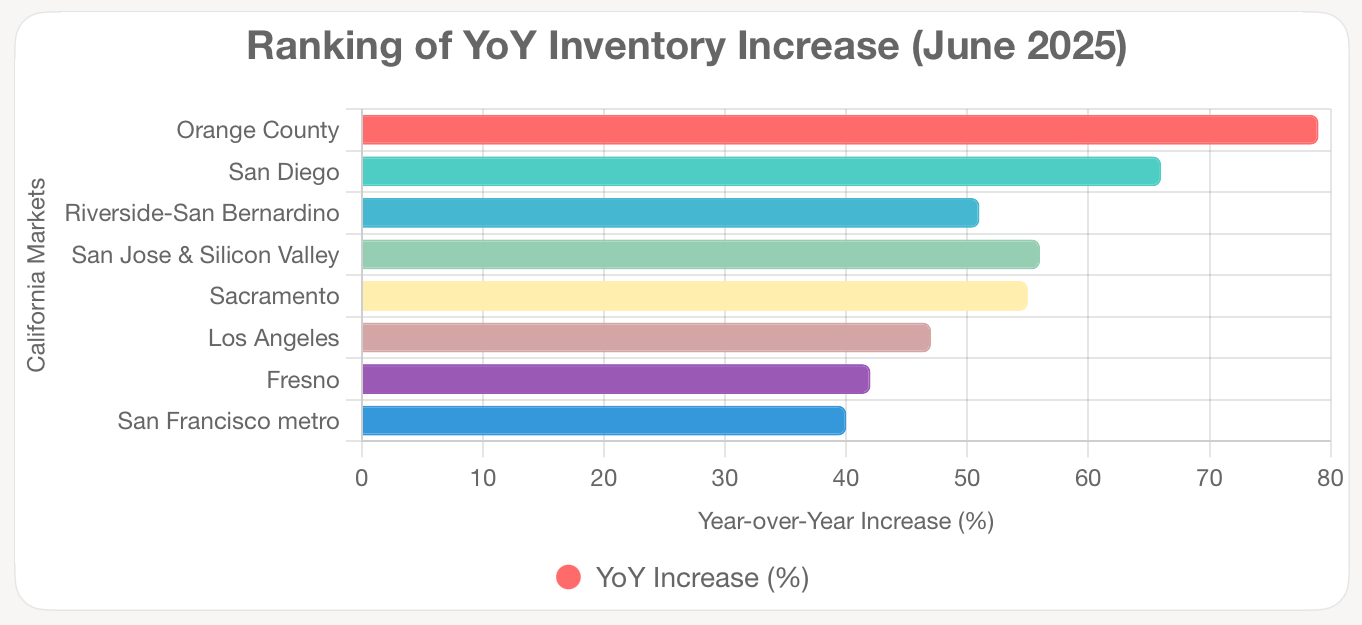

Scott Choppin Note: This Wolf Richter data appears accurate based on the trend of rising inventory in data sources such as FRED, HousingWire, and Realtor.com, with the state-wide 51% YoY increase in April 2025 providing a baseline that aligns with the lower end of Richter’s market-specific figures (e.g., +40% in San Francisco metro). The higher percentages (e.g., +79% in Orange County) seem accurate given California’s unusual market dynamics (cannot find independent sources for this specific data point). This is however in keeping with earlier Richter reports (e.g., May 2025) and upward trend in other data sources are supportive.

Further supporting this trend, the general read of the new home for sale market at this year’s PCBC is that new home markets are crashing, with one well known homebuilder attendee quoting “pessimism from all panelists” and another more bluntly saying “we’re f***ed”. Anecdotally, we hearing of multiple homebuilding companies laying off staff .

National Rent Growth Stalls

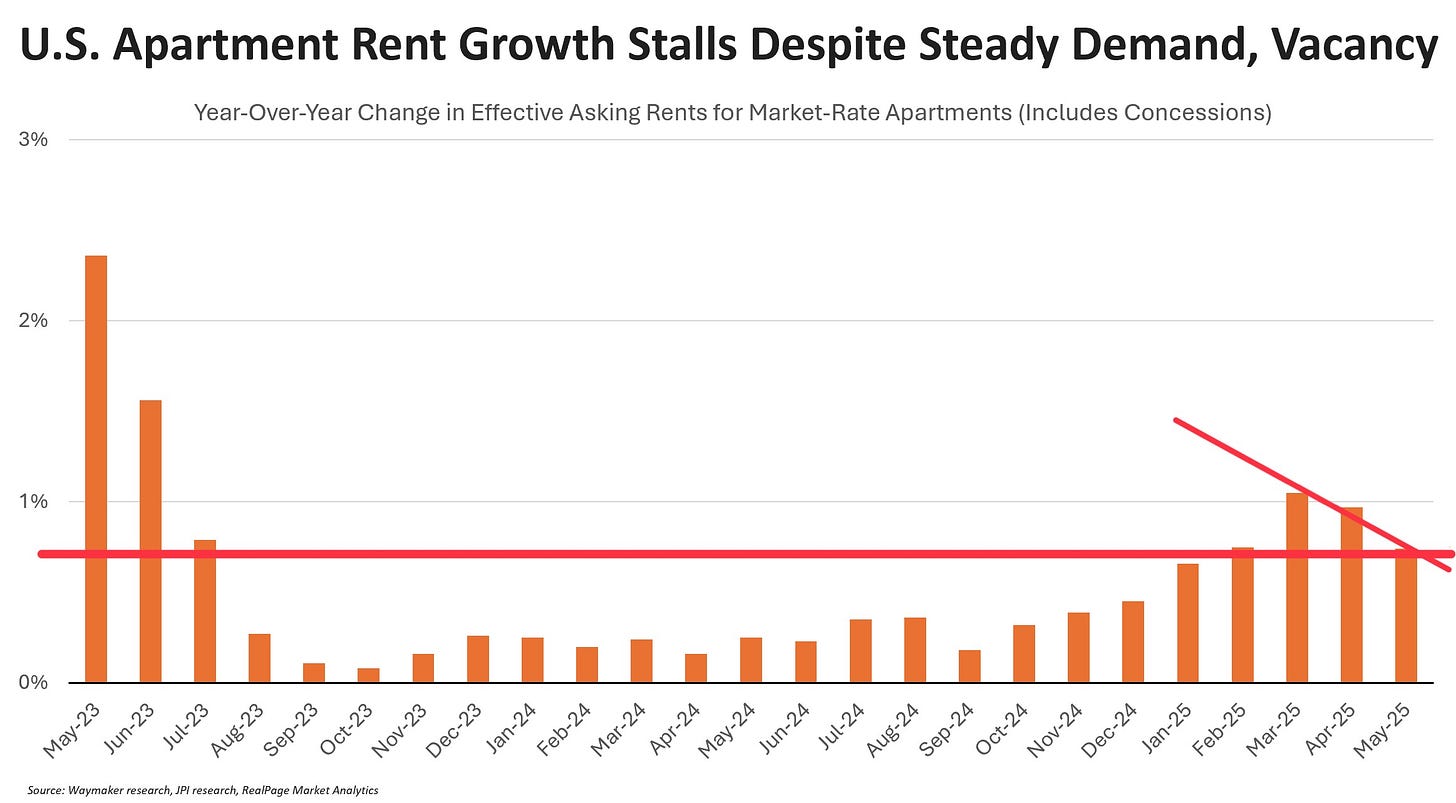

“Apartment demand is strong, vacancy steady and affordability improving (declining rent-to-income ratios) and yet ...

The rent rebound backtracked in April and May, following six straight months of upward momentum.

Why? Apartment operators are nervous.”

Red line emphasis is mine.

BTR Future Trend

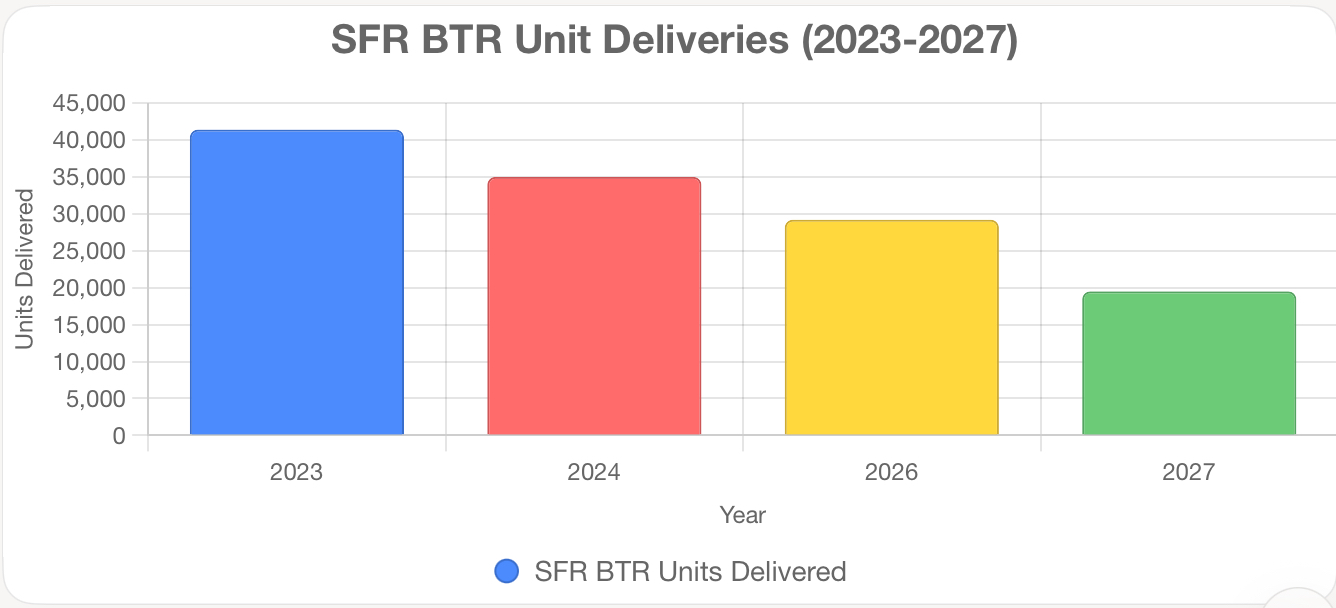

“Wall Street Bets Big on Rental Homes as Mortgage Costs Soar. The gap between home ownership costs and rents creates opportunities for SFR investors.…BTR occupancy is higher than multifamily in most of the markets Yardi Matrix tracks, including Raleigh, the Inland Empire, Las Vegas and Indianapolis. The firm noted SFR BTR supply peaked last year at 41,400 units delivered and has started to cool this year. About 35,000 units are expected to be delivered this year, 29,200 in 2026 and 19,500 in 2027. Units with three or more bedrooms are now more popular than those with two bedrooms or less, according to the report.”

Bold italics emphasis is mine.

Follow On UTH BTR Investment Opportunity

Good news! We’re building more UTH workforce housing for families in California. We have in-place LP equity terms sheets on two UTH porfolios tallying 337 units, slated for delivery in the 2026/2027 time period. A few weeks ago, we presented a $20M Opportunity Zone limited partnership investment opportunity. We are pleased to announce that this investment opportunity has now been fully subscribed. The investment opportunities below, are a follow on to the portfolio investments listed above.

Investment Opportunities:

First, a 4-project portfolio with a major institutional investor, where we are offering a $300K GP co-investment opportunity.

Second, a 2-project Opportunity Zone portfolio, offering a $400K OZ GP co-investment opportunity, on a 2-project UTH OZ portfolio.

Both investments are targeting high 6% to low 7%+ YOC.

Please email choppin@urbanpacific.com for more info.

Please note: This investment opportunity is being offered under Rule 506(c) of Regulation D. Participation is limited to accredited investors only. We will take reasonable steps to verify accredited investor status for all participants. Minimum investment is $100,000. Yields are targeted in the high 6% to low 7% range, but are not guaranteed; all investments involve risk.