The Real Signal #118 - Housing Market Effects Of The Los Angeles Fires

Plus articles on Multifamily Supply Drop Timing Matrix and China 10-Year Rate Falling Off The Map

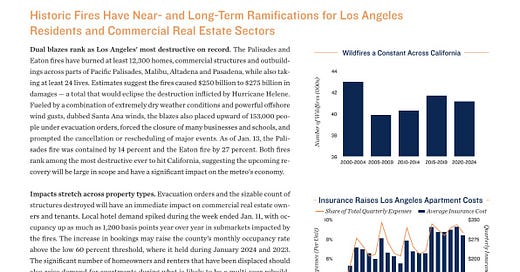

Practical Housing Market Effects Of The Los Angeles Fires

Scott Choppin Note:

I am in several conversations with both brokers and investors about the net effect of the recent fires in Los Angeles.

Notably, some investors are pulling back due to perceived risk. This appears to be overly cautious. They indicate these concerns:

First, perceived risk of declin…

Keep reading with a 7-day free trial

Subscribe to The Real Signal - Housing + Real Estate + Macro to keep reading this post and get 7 days of free access to the full post archives.